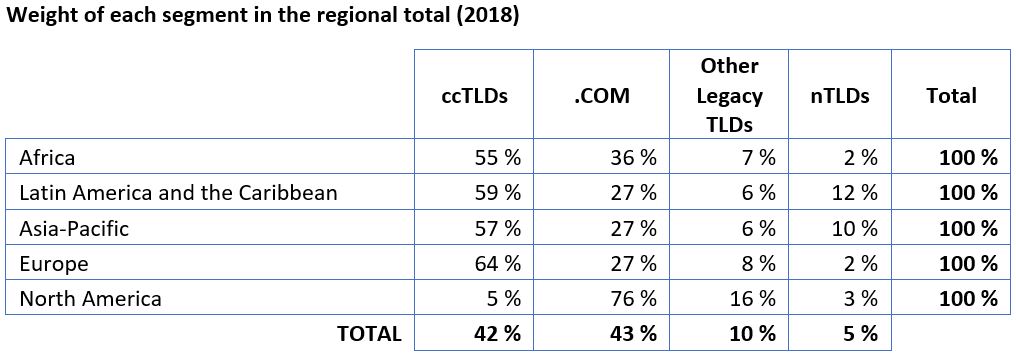

ccTLD domain names account for over half of the domain names registered around the world, except in North America where that figure falls to 5%, according to The Global Domain Name Market in 2018 report, released by Afnic, the .fr registry. Within Europe, ccTLDs account for 64%, Latin America and the Caribbean 59%, Asia-Pacific 57% and Africa 55%.

Among the new gTLDs, there are quite distinct variations in

their market share with Latin America and the Caribbean and the Asia Pacific

accounting for 12% and 10% respectively, while in North America their market

share plummets to 3% and for Africa and Europe it’s 2% in each.

For legacy gTLDs, not including .com, unsurprisingly North America accounts for at least double that of every other region with 16% of all registrations compared to Europe (8%), Africa (7%) and Latin America and the Caribbean and the Asia-Pacific (6% each). For .com, in North America it accounts for three-quarters (76%) of all registrations, more than double and often triple that of other regions – Africa (36%) and the remaining 3 regions 27% each.

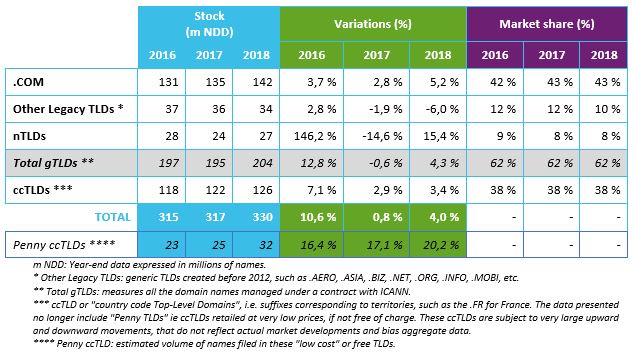

Globally there are 142 million .com domain names, with its

market share increasing 0.5% in 2018, rising from 42.6% to 43.1%. During 2018,

.com’s growth rate increased sharply (5.2% vs. 2.8% in 2017). The “Other

Legacy gTLDs” suffered particularly badly in 2018, losing 6% of their

registrations following a drop of 2% of 2017. For new gTLDs, total registrations

grew 15% around the world, although their market share is still low (8%)

compared with .com (43%) and ccTLDs (38%).

The country code Top-Level Domains (ccTLDs) experienced a

significant slowdown in 2017, but registered growth again in 2018, although it

remained moderate at 3.4% compared to 2.9% in 2017, but as noted, they

represent 38% of the world market share.

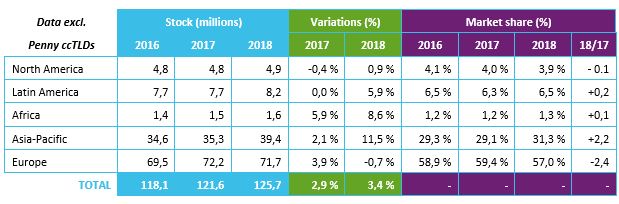

However, the study reveals contrasts between the different regions of the globe when it comes to growth: the strongest growth can be seen in Africa (9%), in Latin America (6%), while the Asia-Pacific registered the highest growth rate overall (12% vs 2% in 2017), which illustrates the rapid development of the internet in these 3 regions.

Europe is the only region to have lost registrations, even

if the drop was small (down 1%). However as in all regions there are variations

with Afnic’s .fr gaining 139,000 domain names in 2018, .pt (Portugal) added 111,000,

while .de (Germany) lost 110,000 and .ru (Russia) lost 350,000.

Although losing 2.4 points of market share, the European

market is still dominant with 57% of domain names filed in ccTLDs (excluding what

Afnic describes as the “pennies”, those domain names sold very

cheaply), followed by the Asia-Pacific region (31%).

For new gTLDs, the report notes how their usage has changed. The main change has been the number of new gTLD domains parked has declined from around 75% in 2015 to around 53% in 2018, while those in “real” use have increased from around 10% to 30%. There has been a slight increase in redirects while errors remain about the same.

But what of the future of new gTLDs? The report suggests

that for those with less than 10,000 registrations, their future is

questionable. Taking into account expenses (ICANN fees, management fees

including staff, technical operator, promotion, etc.) and Afnic estimate a hypothetical

average budget of $100,000 per year. If there’s a registry fee of around $20 for

5,000 domain names (10,000 for a $10 fee, close to .com), Afnic finds that

there are 287 new gTLDs with less than 5,000 domain names (or 50% of new gTLDs excluding

.brands) and 478 new gTLDs with less than 10,000 names (83% of new gTLDs

excluding .brands). This means at present 50% of the new gTLDs are potentially

“loss making” if the registry fee is below the $20 threshold and 83%

if they sell below the $10 threshold.

Afnic note that even if these estimates are relatively rough,

orders of magnitude show that quite a large number of new gTLDs must be in a

fairly precarious situation at the moment. There are, of course, economies of

scale, which the report doesn’t note, meaning large new gTLD registries, in

particular Donuts but also others such as Neustar, Uniregistry, Afilias, would not

need to reach such numbers.

For domainers, when they are not Chinese, the report notes they tend to favour the TLDs that are well-established at the expense of newcomers with a higher risk profile.

To download the report in full, see: https://www.afnic.fr/medias/documents/etudes/Afnic-Global-domain-name-market-in-2018.pdf

This latest Domain News has been posted from here: Source Link